State Land Bank Authority Holds Organizational Meeting

August 27, 2018

Re-established during the 2018 Legislative Session, the Alabama Land Bank Authority (“the Authority”) held its organizational meeting on August 22, 2018. Originally established in 2009, members were never appointed to the Authority as thousands of properties continued to languish in state hands. At the urging of many interested parties, including the Alabama REALTORS®, the Legislature re-established the Authority during the 2018 Legislative Session through Act No. 2018-192. The Authority is specifically tasked with acquiring and selling tax delinquent properties to facilitate productive use of these properties, returning the properties to their highest and best use. Currently, many of these properties have issues ranging from clouded titles or ownership questions, to blight and disrepair. Until addressed, these concerns will continue to negatively impact property values in communities across Alabama.

Members of the Authority are set by the Act, with various state officials being named as members or appointees of members to the Authority.[i]

Meeting

The Alabama REALTORS® Public Policy team was in attendance for the meeting, where the Authority chose officers, reviewed a report by the Department of Revenue on inventory and discussed various matters.[ii]

The Authority elected the following members as officers:

- Chair - Administrator Sarah Moore

- Vice-Chair – Rep. Chris Sells

- Secretary-Treasurer – Superintendent Mike Hill

Following the election of officers, Member Derrick Coleman reviewed a report on the state’s inventory of tax delinquent properties. Here are the highlights:

- 210,054 Properties Sold to the State: Out of an estimated 3.5 million properties in the state, 210, 054 have been sold to the state since 1952.

- 131,492 Properties Redeemed: Of the 210,054 properties sold to the state, 131,492 have been redeemed during that same time period. A further 33,873 have been sold by the state, while over 7,000 properties could not be sold out of bankruptcy or had sales cancelled due to a legal deficiency.

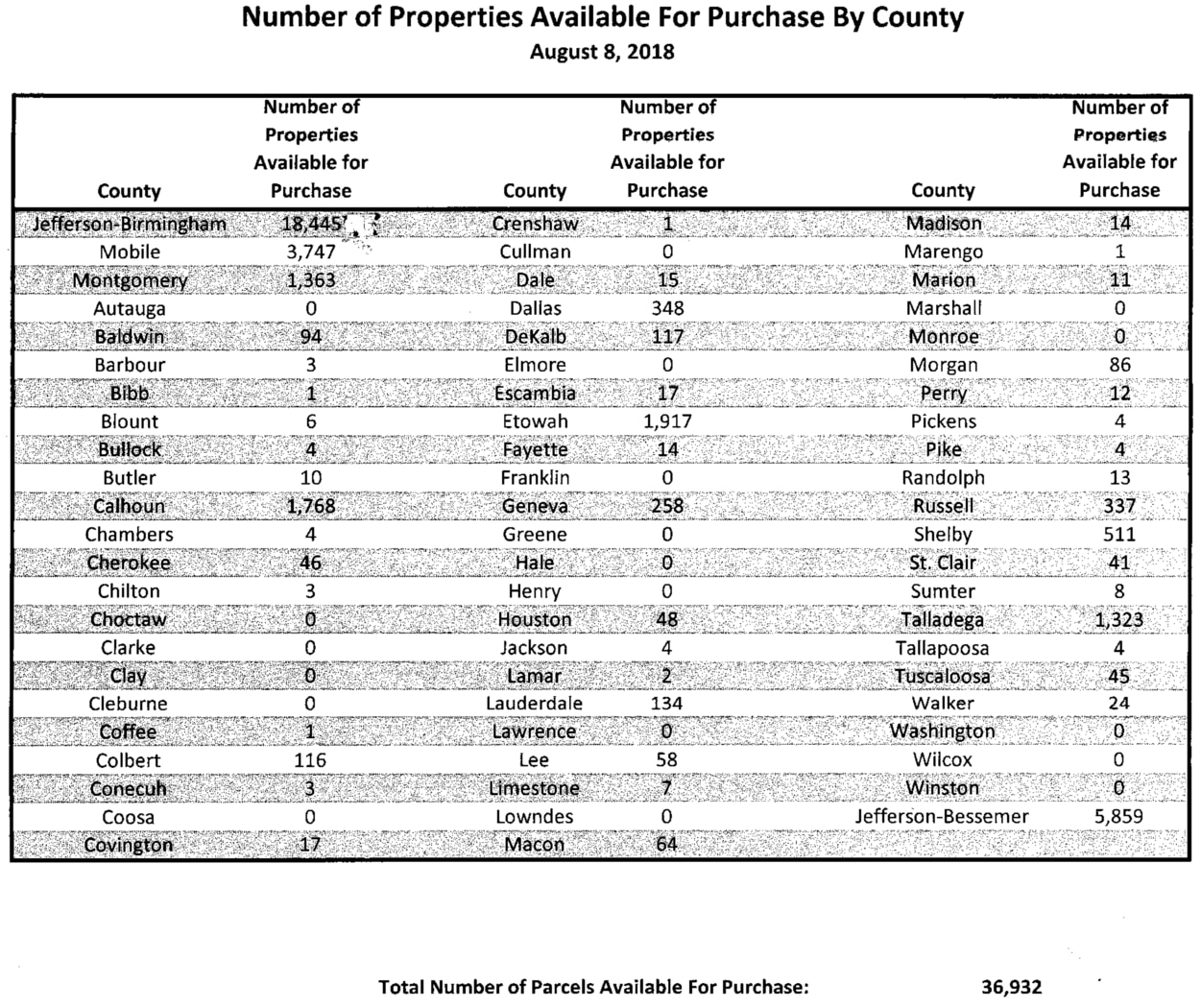

- 36,932 Properties Available to be Purchased: Of the 210,054 properties sold to the state, 36,932 remain for sale. Of these properties, 24,603 have been held by the state for over three years, 20,588 of which have been held by the state for over five years. These are the properties that the Authority is tasked with putting back on tax rolls.

- County Dependent: In the county-by-county breakdown of properties available for purchase, the number of properties available for sale differs dramatically. Jefferson County is by far the largest contributor with over 24,304 properties currently for sale by the state. The next five highest counties are Mobile (3,747), Etowah (1,917), Calhoun (1,768), Montgomery (1,363) and Talladega (1,323). Nineteen counties have zero properties for sale, while an additional 18 counties have 10 or fewer properties for sale. According to the Department of Revenue, the discrepancy is due, in part, to the efforts of the County Revenue Commissioners, some of whom take great pride in having few tax delinquent properties.

The Authority plans to meet again in early October, where it will consider bylaws and rules to govern its proceedings. The Alabama REALTORS® Public Policy Team will continue to monitor the Land Bank Authority and other state regulatory agencies for potential impacts on REALTOR® members, the real estate industry and private property owners.

[i] Currently, those members or designees and their job titles, if known, are as named below. However, not all members have been appointed.

- Kenneth Boswell, Director, Alabama Department of Economic and Community Affairs (ADECA)

- Jay Carver

- Clyde Chambliss, State Senator for Senate District 30

- Derrick Coleman, Director, Property Tax Division, Alabama Department of Revenue

- Linda Coleman-Madison, State Senator for Senate District 20

- John Harrison, Retired Superintendent, Alabama State Banking Department

- Mike Hill, Superintendent, Alabama State Banking Department

- Jimmy McLemore, General Counsel, Alabama Housing Finance Authority

- Sarah Moore, Administrator, Alabama Credit Union Administration

- John Morris

- Chris Sells, State Representative for House District 90

- Ken Wesson, Mayor, City of Childersburg

- Andrew Westcott, Legal Counsel, Office of the Speaker of the House of Representatives

- Susan Wilhelm, Deputy Director, State Department of Finance

[ii] Members present were: Jay Carver, Sen. Clyde Chambliss, Derrick Coleman, John Harrison, Mike Hill, Sarah Moore, Rep. Chris Sells, Mayor Ken Wesson, Andrew Westcott, Susan Wilhelm, and a representative for Kenneth Boswell.